- September 20, 2020

- admin

- 0

Let’s try to understand the building blocks of CAMS business. Buckle up!

The basic facts related to IPO will be discussed at the end.

What does CAMS do?

In simplest terms CAMS is the registrar/ transfer agent of Mutual funds.

If you would google “registrar” you would get “an official responsible for the keeping a register or official records. Majority of revenue comes from Registrar & related services.

Related service- CAMS provides all the services from starting an investment in mutual fund, distributor data tracking, AMC (Asset Management companies), data protection, buying & selling to investor, redemption of funds.

BASICALLY everything & helps in saving a lot of time & resources for AMC if they were to do this by themselves.

In simple terms whole BACK END work is managed by them.

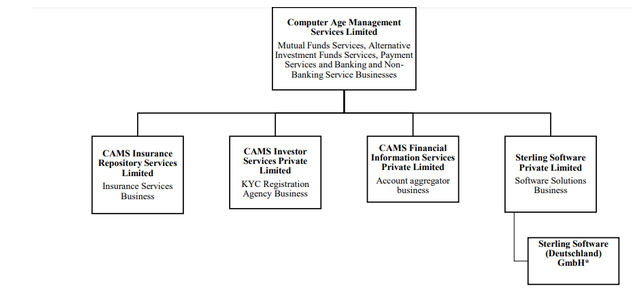

This picture below explains the businesses of CAMS-

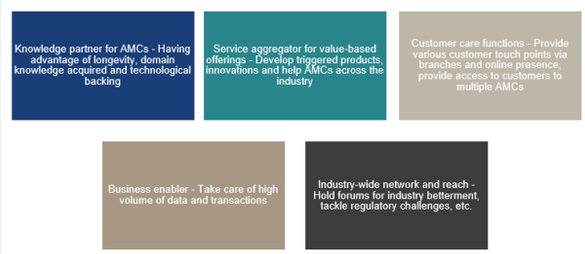

What CAMS does for its Customers i.e. AMC’s AIF’s etc?

How it makes money?

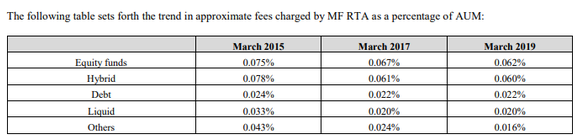

Mostly the revenue model depends on the AUM(Assets Under Management). They charge a % share of AUM maintained & provide service in return.

There is fixed fee until an AMC’s AUM breaches a certain level. Post that there is a tiered structure. Another component being the volume of paper transactions being handled, More costly as they require more work, Expected to reduce in future (obvious) Then game is only upon the volume.

What is favourable for the business?

These are those kind of businesses which will be always in demand, no matter what disruptions happen. It can be included in the list of businesses like Exchange & depository like BSE & CDSL.

Due to the Jan Dhan, Aadhar, Smartphone & Increased internet availability, India will witness & is witnessing Financial inclusion. This is a mega trend. Not for few months & years. Much longer than that. People are also shifting some of their savings from Real Estate & Gold to Financial Assets, Due to low inflation they have become less attractive.

Leader in the industry with 69% market share, Top mutual businesses i.e. HDFC, SBI, ABSL, ICICI are with CAMS. Mutual fund companies generally stick to their registrar due to the convenience & habit.They also benefit from CAMS pan India network of branches as mutual fund houses do not have to necessarily do that expense.

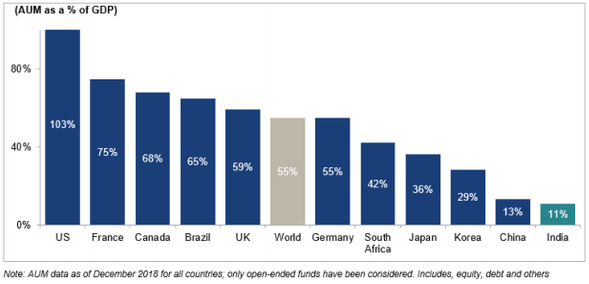

The image below shows the GDP to Mutual Funds AUM ratio of various countries. Although, i do not expect it to reach much higher levels as our per capita income is still very low as compared to these nations .

What is unfavourable for the business?

Although businesses like these stay forever, theme is nice etc. but there is not clean growth path explained by the company. Or there is still less info available since it is an IPO.E.g. CDSL has start running again since its IPO in 2017 because they just found a new growth engine in for revenue in the form of “Charges for Margin Pledging”. Before that there was not growth in the business & stock performance reflected that for past 2–3 years.

Regulatory environment can change anytime. Institutions like Govt, SEBI etc can affect its performance anytime by bringing any rule. That overhang is always there.

- E.g. Mandatory cut in “Total Expense Ratio” by SEBI led to decrease in their revenue

- When you handle so much confidential data, there is always risk of Data Theft

- At present scenario, there is outflow of money from Mutual funds as People do not have extra money.

- A lot of people are fed up with the under performance of mutual funds over the past 3–5 years.

- Those people are trying to invest in direct equities

- This could be bad for mutual funds in short term & directly affecting business of CAMS for short duration.

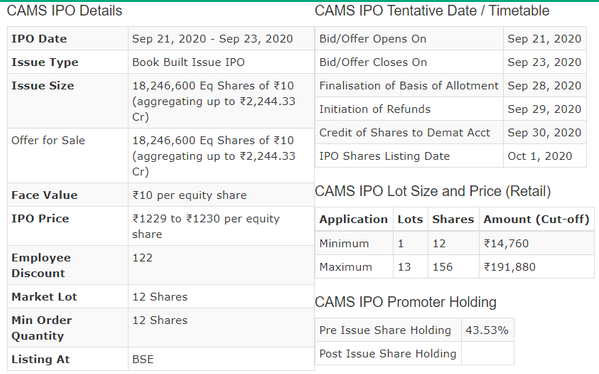

Basic info for Applying in the IPO-

I believe now the business of CAMS is clearer to you. & you can make a more informed decision.

The above guest post was done by Mr. Yash Seth

If you liked this article, please do share share it (Whatsapp, Twitter) with other Traders/Investors.