- July 1, 2020

- admin

- 2

There are many working professionals who want to trade but due to time constraint they hardly find any time for analysis, so most people focus on short term trading, buying stocks and holding for few days and exit it in a week or so and make profits/loss.

In this article, we shall focus on a trading style where many people follow. Usually people track weekly gainers/losers and try to invest in those stocks which has show some significant action. So we shall analyse two things,

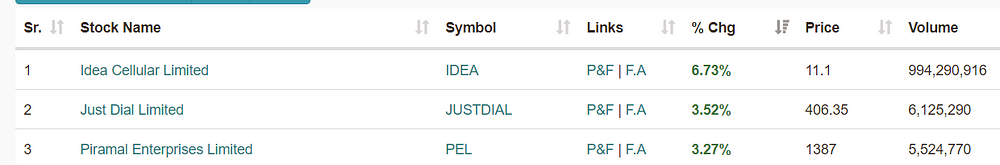

- What would have been the next week returns if i invested in top 3 weekly gainer stocks this week?

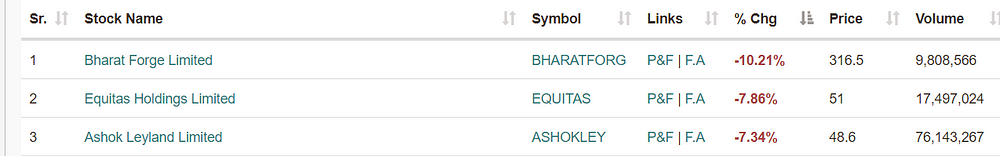

- What would have been the next week returns if i invested in top 3 weekly loser stocks this week?

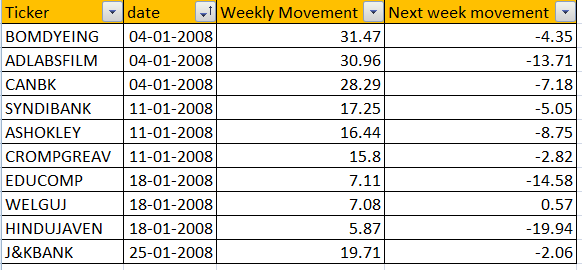

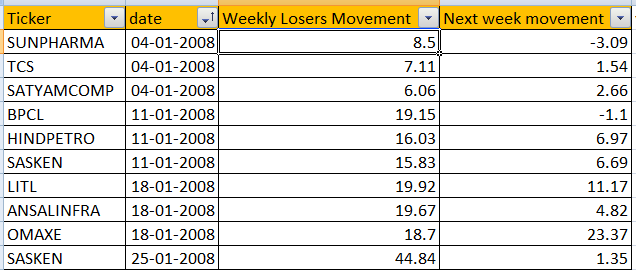

I have gathered data from 2008 to 2020, for the last 12 years covering all types of market, bull market, bear markets and sideways markets.

First we shall analyse the weekly gainers performance, the idea behind this strategy is, by Friday after 3:20 PM, we will know what are the list of stocks that gained/lost the most in the week. Pick top 3 from this list and go long on these stocks and exit next Friday. So we just hold only for one week, and keep repeating week after week, all we have to do is just spend few mins every Friday and run this scanner, which would give us the list of stocks that satisfies the condition of

gainer : top 3

Loser: top 3

We will do the backtest to find which gives the best results, going long on weekly gainer or going long on weekly loser.

To backtest from 2008 to till date, we need to use the list of stocks that were part of FNO stocks during the respective period. We used these data and took what are the list of top 3 weekly gainer/loser and how it moved next week, for last 12 years of data.

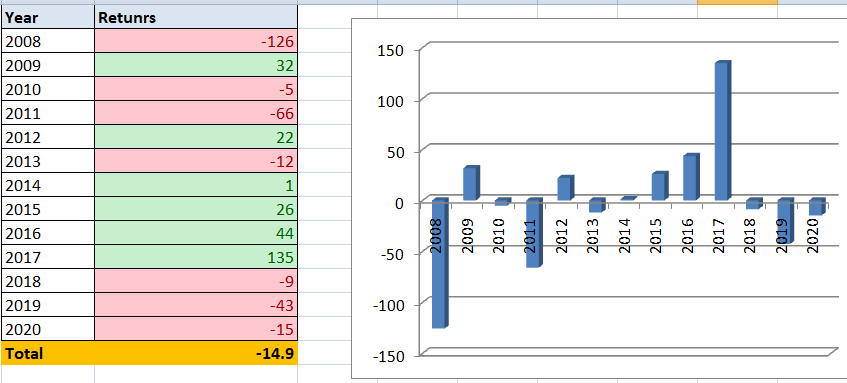

Finally we calculated year wise returns, here’s the returns for list of top 3 weekly gainers stocks, their returns if we had gone long in them. 2017 year was the only year with exceptional returns, and we know that because of the bull market in 2017, most of the stocks were gaining, so this strategy ended up with high returns, but rest of the years, it has ended in up in negative over all.

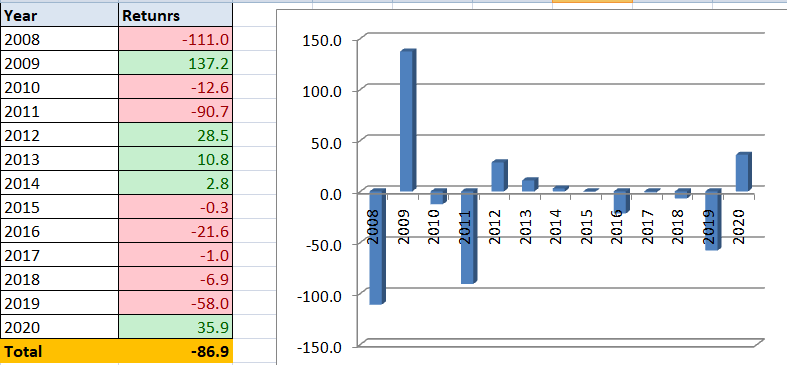

Here’s the returns for list of top 3 weekly losers stocks, what would have been the total returns if we had gone long in them and exited following week. Only year 2009 was exception, rest all years it was either flat or negative.

Conclusion:

With the last 12 years of data analysis, we could confirm that buying the stock that gained the most in a week or lost the most in a week and exiting it in the following week, has not given good returns. If you are buying stocks based on this logic, its better not to follow it, as with law of large numbers, its going to end up in loss over the longer period.

If you liked this article, please do share share it (Whatsapp, Twitter) with other Traders/Investors.

Excellent findings

Great