- November 29, 2020

- admin

- 0

As we all know that due to SEBI/NSE guidelines, Intraday margin’s are getting increased from Dec 2020 onwards, slowly on phased manner the margin requirement would keep on increasing. Let’s calculate what is the new margin required to do Intraday option selling, Short Strangle (One lot OTM call and Put)

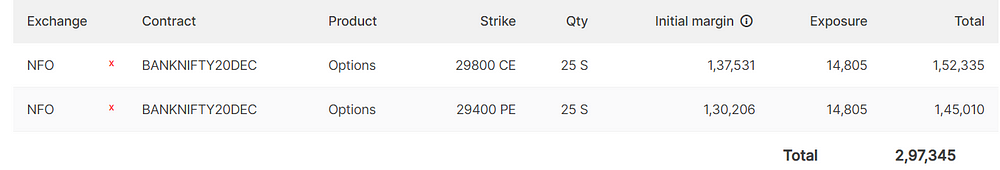

currently Bank Nifty spot is at 29600 levels, so if we short 29800 Call and 29400 Put

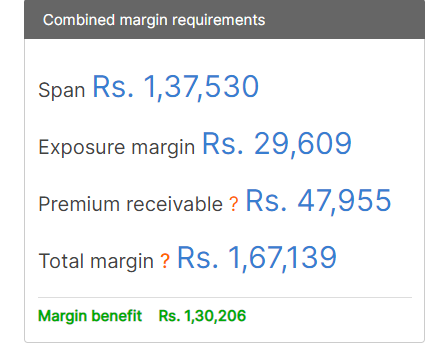

As per Zerodha margin calculator, NRML(SPAN+EXPOSURE) margin required is Rs.1,67,139.

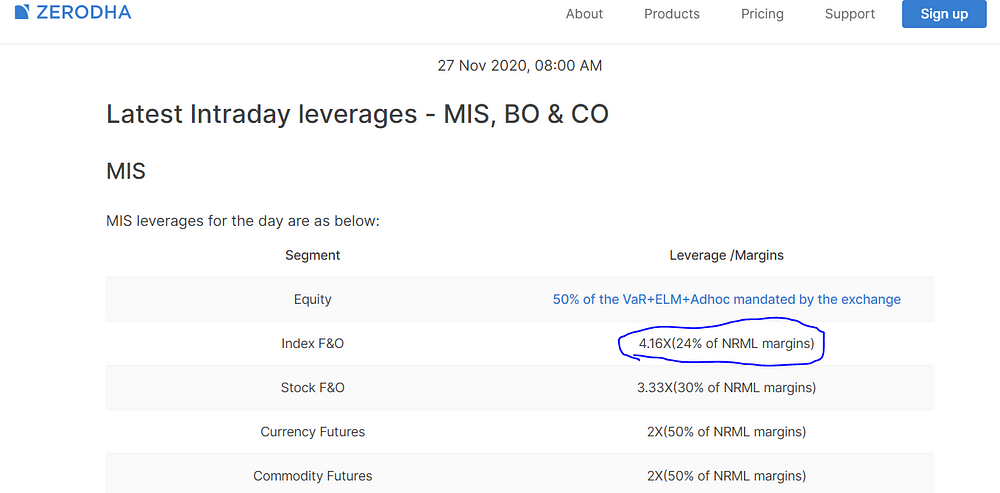

From Dec 2020 to Feb 2021 — if a trader has 24% of this NRML margin, which is around Rs.40,000 he can take intraday position. i.e. he can short one lot of call and put option.

March 2021 to May 2021 — if a trader has 50% of this NRML margin, which is around Rs.85,000 he can take this intraday short strangle position.

June 2021 to Aug 2021 — if a trader has 75% of this NRML margin, which is around Rs.1,25,000 he can take this intraday short strangle position.

From Sept 2021 — You need to have 100% of NRML margin, which means from next year Sep onwards both Intraday and Positional trades will have same margin.

As you can see, slowly the intraday leverage is getting wiped out. Only way to reduce the margin requirement is to introduce hedge position. Consider we are trading Intraday Short Strangle strategy with a fixed stop loss. We know the risk is limited as we have stop loss in place, but exchange doesn’t care about the stop loss, so by introducing additional Option buy legs on either side, we protect the risk also we can reduce the margin required drastically.

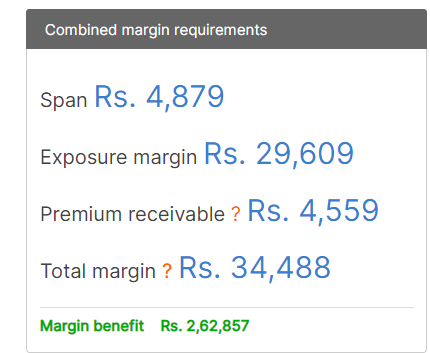

If Bank Nifty is at 29600,

Short — 29800 Call and 29400 Put

Long — 30000 Call and 29200 Put

By adding the option buy leg, our required margin is drastically reduced to just Rs.35,000 now.

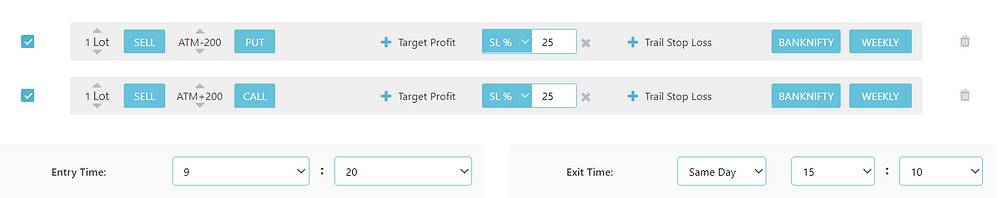

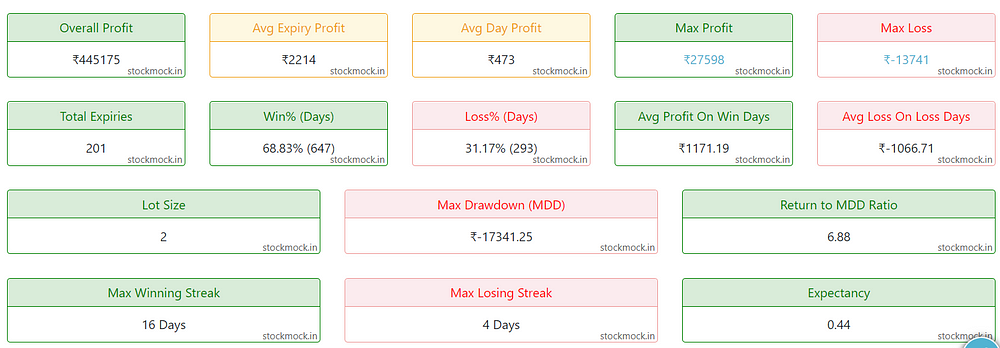

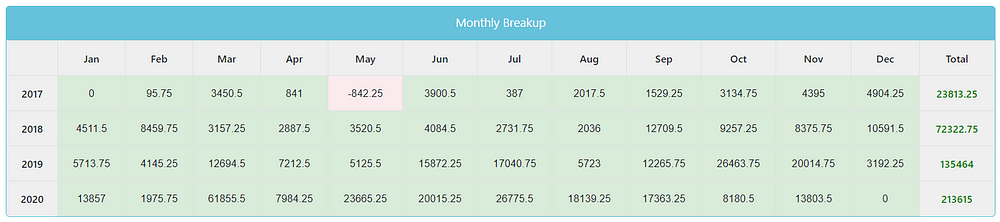

If we backtest the Intraday Short strangle strategy with 25% stop loss on each leg with Stockmock platform, this is how the returns looks like.

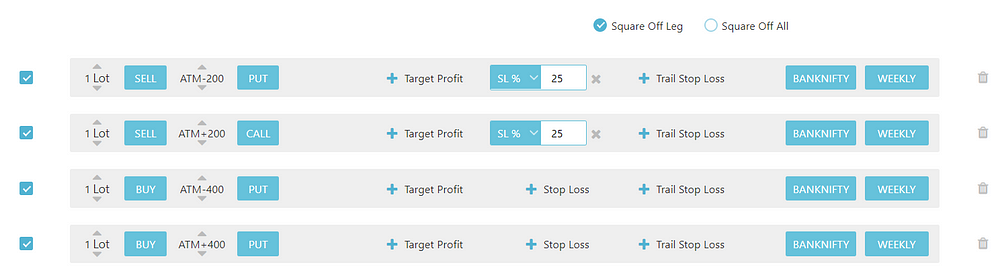

Now we shall add option buy legs on either side, so we shorted 200 points OTM options and bought 400 points OTM options. If Bank Nifty is at 29600, we Shorted — 29800 Call and 29400 Put with 25% stop loss, then went Long — 30000 Call and 29200 Put. Please note that the long positions doesn’t have a fixed stop loss because of the following reason.

- If stop loss is hit in long position and if short position is still open, then margin requirement will increase, hence we need to keep the long position open with out any stop loss

- We do not close all legs if stop loss is hit any one of the leg, because after stop loss is hit, market tend to move in one sided direction most of the time, so by keeping the other leg open, we get maximum profits, consider market moved up and hit stop loss on the call strike that we shorted, now as long as market moves up, the call strike that we went long will continue to gain and the put short that we kept open will continue to decay. So we tend to make higher profits.

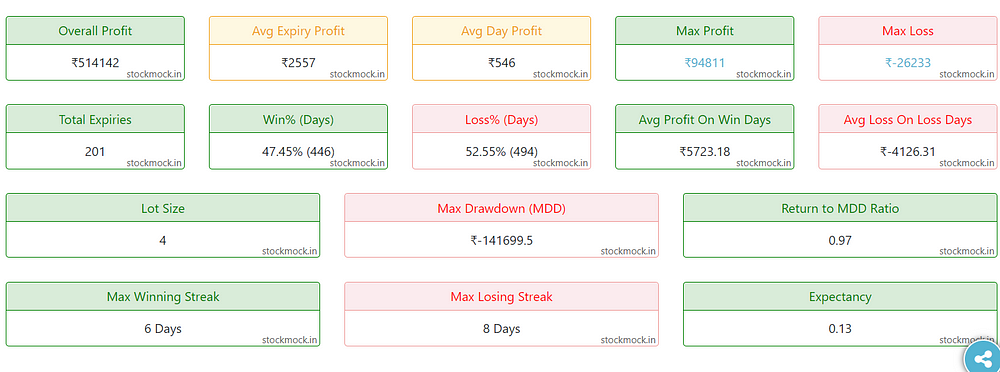

Here’s the gross backtest report with 4 legs, though max drawdown is higher, profits made are comparatively higher and also it is achieved with very less margin.

You can try testing option selling strategies in this stockmock platform and see if the results are good by adding long positions to your option selling strategies. If you liked this article, please do share share it (Whatsapp, Twitter) with other Traders/Investors.