- June 5, 2020

- admin

- 6

Back testing a trading strategy is a vital part in Trading, only when a trader follows a predefined rules, he can make money in the longer run. Though there are many back testing tools available for back testing, due to limitations in coding knowledge not every trader can use these tools to backtest. And platforms like Zerodha’s Streak is good for beginners stage if one wants to backtest on stocks.

But the most liquid and most traded segment in India is Index options, if one can build a robust strategy with options, he can easily make consistent returns. But one need a options data, along with a platform which doesn’t require any coding knowledge to back test a strategy, once such platform is www.stockmock.in (please note that we are neither promoting this site nor anyways related to this site, we really find this platform very useful, so wanted to spread the news to many other traders)

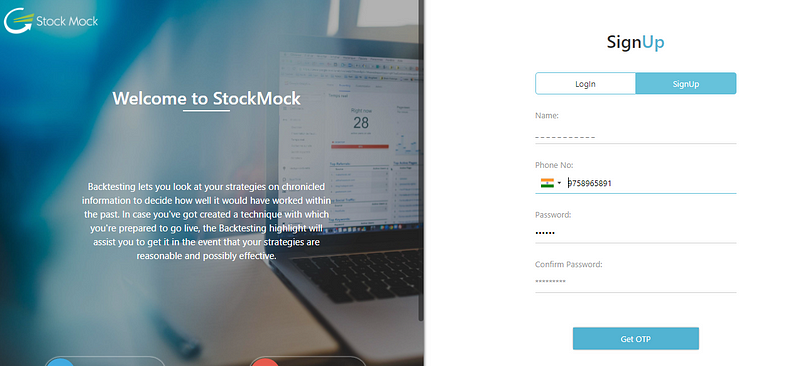

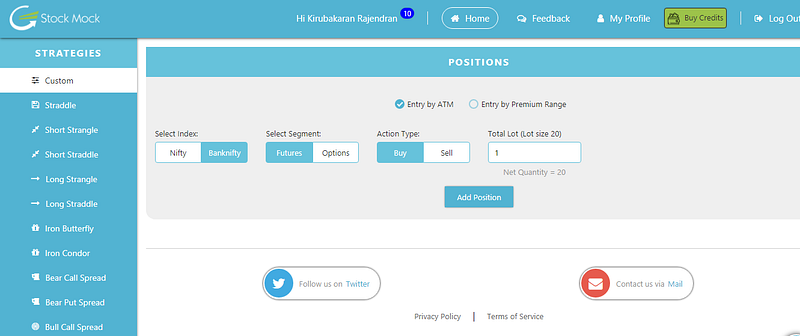

Users just need to sign up with their platform for free using your mobile number and then the home page provides you with list of most popular options strategies that you can backtest for Nifty and Bank Nifty.

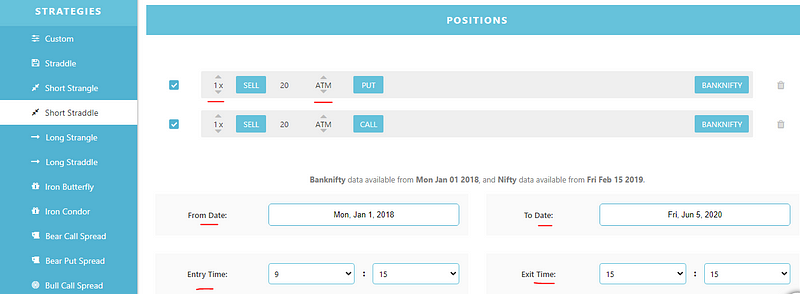

Every option trader knows about Short Straddle, long straddle, strangles etc, but how do we confirm with data, whether these strategies really makes money. Let me select Short Straddle for an example

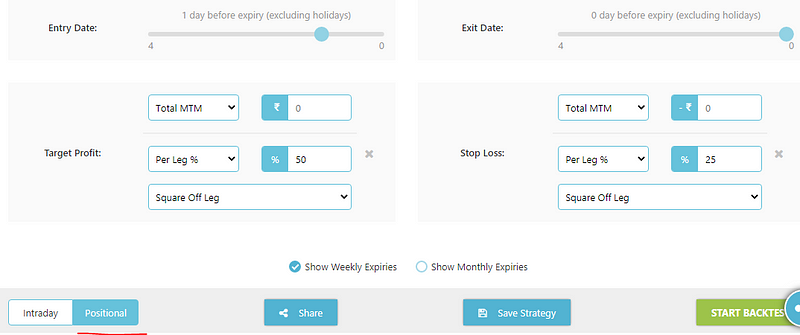

I can customize how many lots i want to back test, we can also change if we want to short ATM options or ATM+100 strike price, we can speicfiy from date to date and even entry time, stockmock.in provides intraday backtest, so you can easily select any time frame.

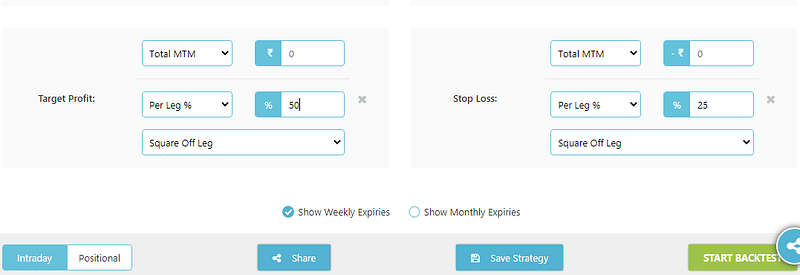

You can also specify the targets and stop loss you want to use in your strategy and test it.

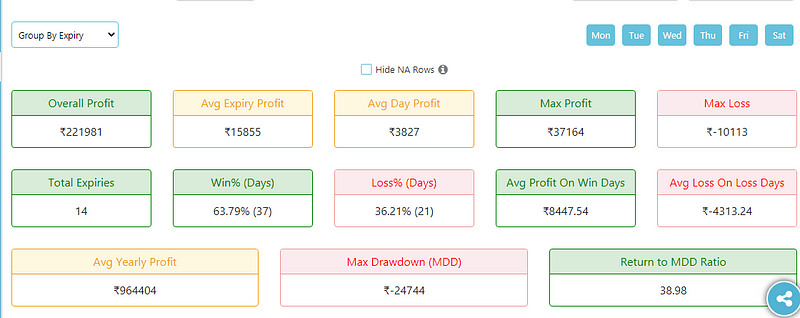

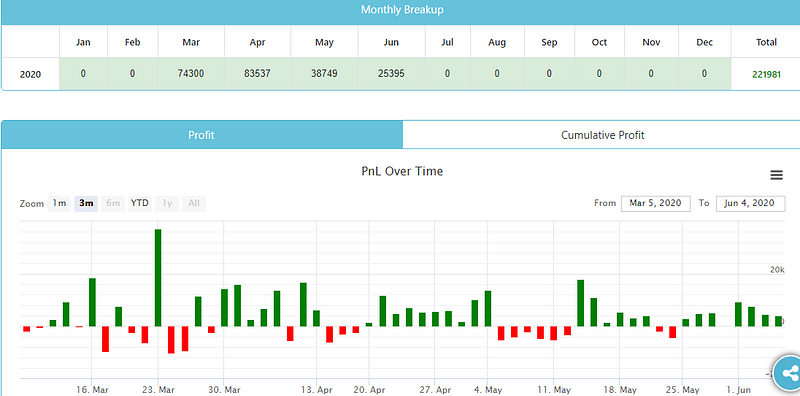

I just wanted to know how much Short Straddle can make if I enter at 9:15 and exit at 3:15 by keeping 25% of premium as stop loss. Here’s the result from Jan 2020 to June 2020, it made more than 2 lacs profit.

It has made consistent profits month after month even in this volatile period.

Even stockmock platform supports positional backtest as well, simply select Position button at the bottom and mention entry date and exit date by moving the sliders.

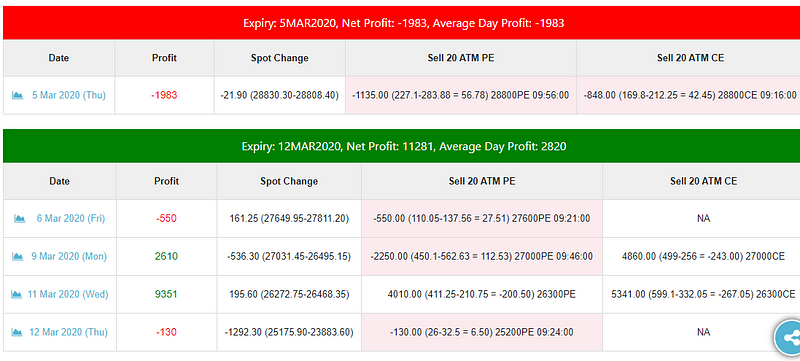

They even provide detailed trade metrics explaining what happens on trade to trade basis.

- StockMock has Banknifty data available from Mon Jan 01 2018, and Nifty data available from Fri Feb 15 2019.

- StockMock assigns 10 Paid Credits on SignUp and 10 Free Credits daily to every user(who has no paid credits). Free Credits are assigned so that user can explore the system.

We really don’t need complex systems to make money in stock market, a simple trading strategy can do wonders if one follows robust risk management and compound it with good money management. Start your back-tests with StockMock

If you liked this article, please do share share it (Whatsapp, Twitter) with other Traders/Investors.

appreciate your genuine efforts .. 🙂

“I just wanted to know how much Short Straddle can make if I enter at 9:15 and exit at 3:15 by keeping 25% of premium as stop loss.”..

Result are good, how to automate this in a trading platform. i have account with zerodha

YOU CAN CHECK THE SAME IN STOCK MOCK WEBSITE

could be better. atleast there is something

what could be better

Thank you Kiru. It is true as you said simple things works great and your many built strategies already proved it