- September 10, 2019

- admin

- 0

Position sizing is one of the important factors in trading which plays a vital role in any trading system. Each trader will have their own trading rules based on their belief in the markets. Even a mediocre trading strategy can be turned into a good one using simple position sizing rules.

Usually it is recommended not to risk more than 2% in a trade.

Trading is the only profession where you can see Doctors, Engineers, and many other successful professionals try their luck with stock market, these people excel in their own respective field but struggle a lot when it comes to trading.

Unfortunately, everybody believes that a successful trader always has a secret Technical Skill. But the truth is Technical skill is the least important factor to be a superstar trader.

Then what separates a great trader from the group of average traders?

Its their emotion & money management rules.

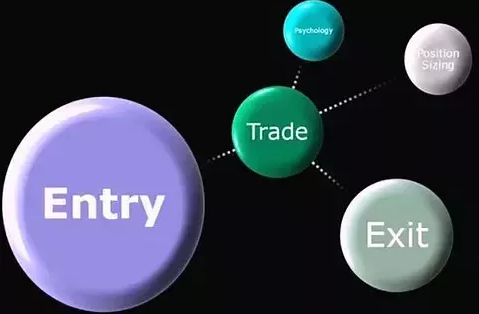

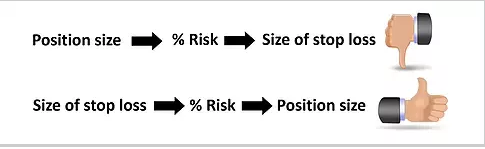

This is how most traders think:

They first think about the Entry point, at which price should I buy? At which level should I enter? At which point should I get into a trade?

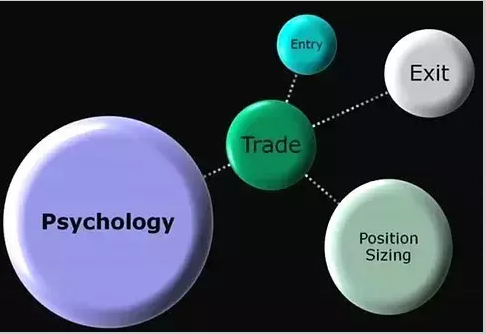

But this is how you must think to be a profitable trader.

You have adapt to trading strategy that suits your psychology, assign trade management rules, keep position sizing and money management rules.

One of the main reason people lose money in stock market is because of their position size.

Consider the following example:

Vicky starts trading with a capital of Rs. 1,00,000 and he finds a trading opportunity and buys Spice Jet share for Rs. 100. At the max, he can buy 1000 shares of Spice Jet stock.

Now if the stock gains 110 in few days, he will gain 10*1000=10,000. That is 10% of his capital. He sells all his 1000 shares, making 10% returns in short span, makes him more happy and wants to try his luck again.

Consider if he makes an purchase again of 1000 shares at 100, what if the stock goes down to 90 from 100? He will lose 10% of his capital in short span of time, but he may hold the stock and if continues to slide 90, 85, 80. He panics and sell all his shares at 80, losing 20% of his capital.

What made Vicky panic? Spice Jet stock falling from 100 to 80?

No. Its 1000 shares that he bought made him panic.

Imagine, if he had 100 shares. Stock falling from 100 to 80, results in 2000 loss. Which is just 2% of his capital. In this situation, Vicky might be in a better position to make wise decision.

So next time you buy a stock and want to know how many shares you need to buy, follow the below rules.

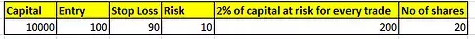

A. Capital:Rs. 10,000

B. Entry Price of your stock: Rs.100

C. Stop loss: Rs.90

D. Risk: Rs.10

E. We should risk only 2% of capital: 2% of 10,000=Rs.200

So if the trade goes wrong, we will lose only 2% of capital.

F. No of shares: Rs.200/Risk (formula= E/D)

So when you buy 20 shares, if the trade goes against us and hits stop loss, we will lose 20*10=Rs. 200 only which is just 2% of the capital.

Many traders will have a trading psychology issue when they scale up their trading size.

I have read a wonderful story in Quora written here Monica Lohchab’s answer to Why can’t I study for long hours? which very much relates to trading.

Meet Milo of Croton — The Great Ancient Greek Olympian.

He was the greatest and strongest wrestler of Greece.

He won six consecutive olympic medals! Remember what Usain Bolt said? Win three and become immortal? Imagine six !

How did he become so strong?

He started his training by lifting a new born calf. Hah! So easy peasy. I can lift a calf. You too can lift a calf. What’s the point in lifting a tiny calf? Huh.

Whereas his competitors attempted to lift an adult bull instead. Yo. And they all laughed off the calf lifting. Who does that! Stupid Milo. Huh.

Milo carried the calf daily, all the time. The calf grew slowly and so did Milo’s strength.

And ultimately Milo could lift a bull effortlessly.

But his smart ass competitors were still trying to lift the bull. Sometimes succeeding, maybe, but not excelling like Milo. Smart Milo.

Learn from Milo.

Buy a calf. Lift it daily. Rather than lifting a bull.

If someone is trading with 50 lot size and over a period if he makes more profit and decided to increase his size from 50 to 100 , then he will definitely have tough time trading the same strategy. Remember nothing has been changed here, all his trading rules are same but still he would struggle to trade.

It because, he is more used to 50 lot size, when he is trading with 50 lots , he is used to the negative MTM, daily losses, max losses etc. As he traded with that fixed size for a longer period, he is used to these daily fluctuations in his account.

Now after seeing good profits, if he decided to double the size he would not be able to handle it efficiently. So after some losses he would again go back to the same old position size of 50 lots and he would keep trying to increase it to 100 but he would fail every time.

Instead He has to gradually increase his position size, instead of doubling the size at one go. That’s why it is advised to trade based on risk % on capital rather than a fixed size, which will help us in reducing the drawdowns.

Happy Trading!

Follow us on our Telegram Channel, Youtube and blog.

If you liked this article, please do share share it (Whatsapp, Twitter) with other Traders/Investors.