- October 24, 2019

- admin

- 0

Earlier this year, Indian Stock Markets were flooded with IPOs of some well known brands like DMART, INDIGO, LEMON TREE Hotel.

Most of us know that all these companies are known brand and hence their IPOs were over subscribed and had good listing. Many retailer traders applied for the IPO but many of them did not get allocation, but you don’t need to worry about it. Because there still lies some opportunity to make some money.

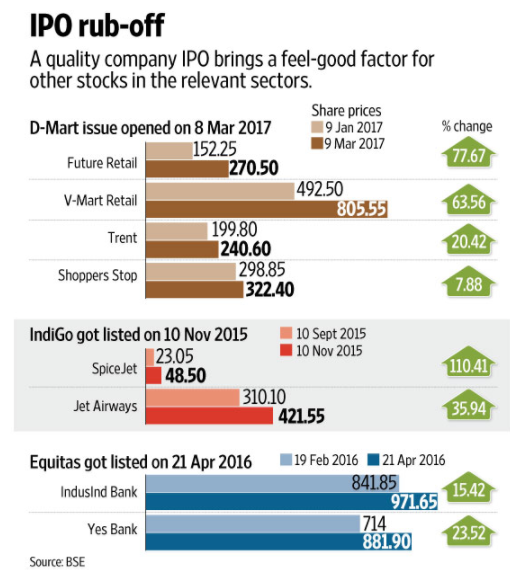

When DMART ipo was in lime light, the other stocks in same sector like Future Retail Ltd and V-Mart Retail Ltd starts getting investors attraction.

The below chart shows the percentage of movement in Future retail — Vmart share price before Dmart listed. Both the stocks gained more than 60% in less than 2 months time.

Whenever an interesting company approaches the markets with an initial public offering (IPO), there is always a rub-off effect on other stocks in the same sector, said Arun Kejriwal, director of Kejriwal Research and Information Services Pvt. Ltd. Valuations get corrected by improving, he said, adding, “This is a consumption mindset and it has happened whenever a good company is about to get listed.”

“In case of D-Mart, people might think the issue would be oversubscribed heavily and that other stocks of the sector will also continue to do well,” he added.

The similar movement happened when Indigo IPO came in.

According to an analyst, if people don’t know much about a sector and a quality company comes, it leads to reassessment of valuations of listed entities also. A case in point is InterGlobe Aviation Ltd that runs IndiGo and is the most profitable airline. “IndiGo was an airline that was expected to make an annual profit of Rs2,000 crore. No one thought that kind of thing was possible in aviation,” said the analyst. That led to a rerating of the sector before IndiGo was about to get listed.

Shares of SpiceJet Ltd and Jet Airways (India) Ltd had gained 110% and 36%, respectively, two months prior to IndiGo’s listing

A similar phenomenon was observed with Lemon Tree Hotel IPO. Other hotel stocks like EIHOTEL & INDHOTEL moved up 17% and 10% respectively in short span of time.

Next time when a well known brand comes to IPO, have an eye on same sector stocks. May be you could make some quick gains.

I have written this article in Quora few months before, sharing the same in Medium now. You can check my Quora profile to read more articles related to stock market.

Happy Trading!

Follow us on our TelegramChannel, Youtube and blog.